In achieving this objective, this study provides useful insights about the effects of implementing public policies in the taxation area which contribute to the reduction of tax evasion, which is relevant to the government and society as a whole. This choice is justified by this state’s participation in the EI pilot project in 2006, which up until now has not been addressed by any study of this subject. To accomplish this, we have performed t tests in a quasi-experiment by using difference-in-difference estimation regressions for a specific state, in this instance Goiás. This article therefore seeks to fill this gap by verifying whether the EI program has fulfilled one of its roles, namely, increasing tax revenues through greater control of tax assessment.

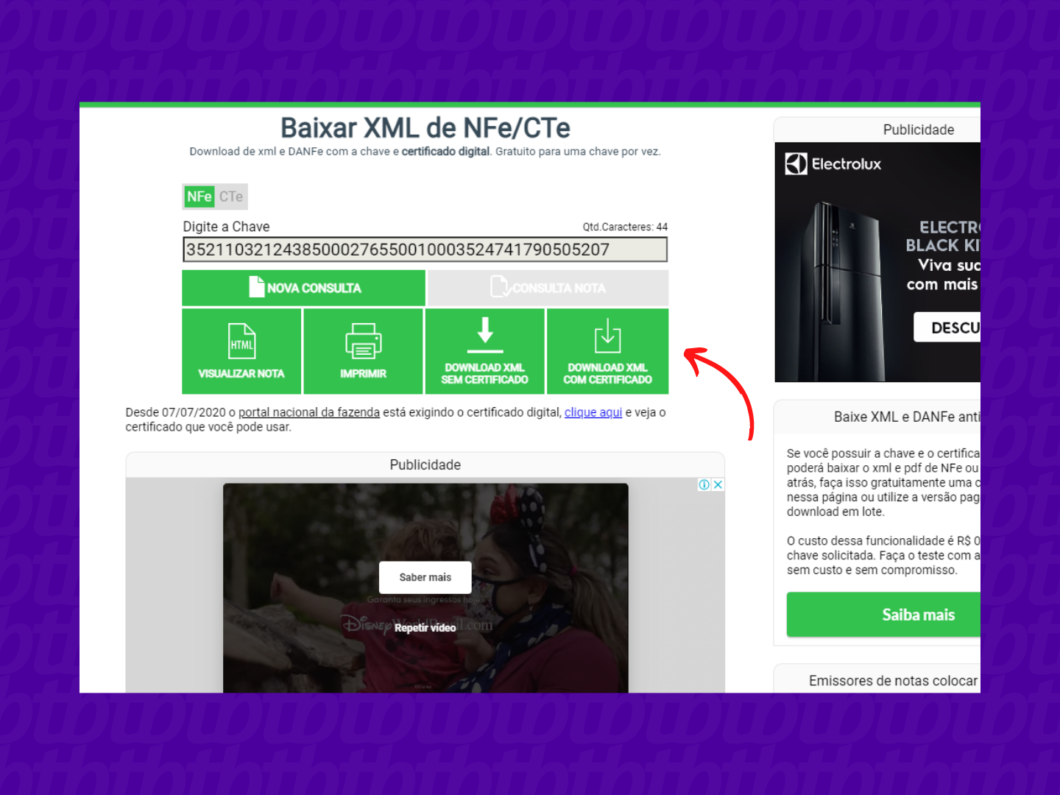

#Chave de acesso nota fiscal manual#

Thus, the effect of the transformation of a manual process into an electronic process for the emission and receipt of invoices on state tax revenues is a gap that still needs to be explored. Consumers as tax auditors (Working Paper).

Revista Brasileira de Economia, 67(1), 97-120. Programas de incentivos fiscais são eficazes? Evidência a partir da avaliação do impacto do programa Nota Fiscal Paulista sobre a arrecadação de ICMS. Others are focused on the analysis of taxation education programs which use the EI, such as the São Paulo Invoice ( Mattos, Rocha, & Toporcov, 2013 Mattos, E., Rocha, F., & Toporcov, P. Universidade Federal do Ceará, Fortaleza, CE.), which does not consider external economic variables.

Impactos da Nota Fiscal eletrônica na arrecadação do ICMS no estado do Ceará (Dissertação de Mestrado). Few studies have examined the program’s effectiveness, such as Barbosa (2011 Barbosa, M. However, empirical evidence regarding this aspect is still lacking in the literature. Thus, the implementation of the EI program intuitively generates the idea of an evolution in tax assessment and collection processes in the states. Altera o Sistema Tributário Nacional e dá outras providências. 42, 2003 Departamento Intersindical de Estatística e Estudos Socioeconômicos. This program’s main objective is to modernize Brazilian tax administration by reducing bureaucratic costs and obstacles, facilitating contributor compliance with tax obligations and improving the control of tax administration bodies ( Emenda Constitucional n. The Electronic Invoice is a federal program prepared by the country’s tax administration to institute a unified model for electronic invoices throughout the country, substituting paper invoices in the industrial and wholesale sectors ( Receita Federal do Brasil, 2007 Receita Federal do Brasil. Política pública fiscal Factura Electrónica recaudación del estado

Así, aunque el enfoque principal de la NF-e no es el aumento de la recaudación de impuestos, se puede observar que la institucionalización de un programa de estandarización y compartición de documentos fiscales incluyó mejoras en los procesos de fiscalización de la administración tributaria, aumentando la recaudación de impuestos del Estado a través de la reducción de la morosidad fiscal. Los resultados indicaron que el promedio de recaudación en el estado de Goiás es estadísticamente superior en el período posterior a la implantación de la NF-e y el aumento de la recaudación de las empresas obligadas a emitir NF-e fue mayor que el de las que no son obligadas. Para la investigación, se utilizaron pruebas de promedios y estimación de regresiones de diferencia en diferencias ( difference-in-differences). Public fiscal policy electronic invoice state collectionĮl objetivo de este artículo es verificar si la implementación del programa de Factura Electrónica (NF-e, por sus siglas en portugués) generó, como consecuencia, algún aumento en la recaudación en el estado de Goiás. Therefore, although the main focus of EI is not the increase in tax collection, it can be observed that the institutionalization of a program of standardization and sharing of fiscal documents included improvements in the inspection processes of the tax administration, increasing the collection of state taxes through the reduction of tax default. The results indicated that the average collection in the state of Goiás was statistically higher in the period after the implementation of EI and that the increase in the collection from companies required to issue EI was superior to the collection from those not required to during the period of investigation. For the research, means test analysis (t-test) was used along with the estimation of regressions difference-in-differences. This article aims to verify if the implementation of the Electronic Invoice program (EI), generated an increase in the collection in the state of Goiás, Brazil.

0 kommentar(er)

0 kommentar(er)